The eBay credit card can be a great no annual fee card to add to your wallet. If you are a frequent eBay customer, you’ve probably seen many advertisements for this card. The latest sign up offer is for $30 back after spending $150 within the first 30 days. The eBay credit card is issued by Synchrony bank. I don’t think the card is very difficult to be approved for as I was instantly approved when I applied.

eBay Credit Card Rewards

The primary reason to get the eBay Mastercard is for the rewards. The card has a variable point earning structure based on spending categories.

- Earn 3 points per dollar on eBay purchases (increases to 5 points per dollar after you spend $1,000 at eBay in a year)

- Earn 2 points per dollar on gas, groceries, and restaurants

- Earn 1 point per dollar on all other purchases

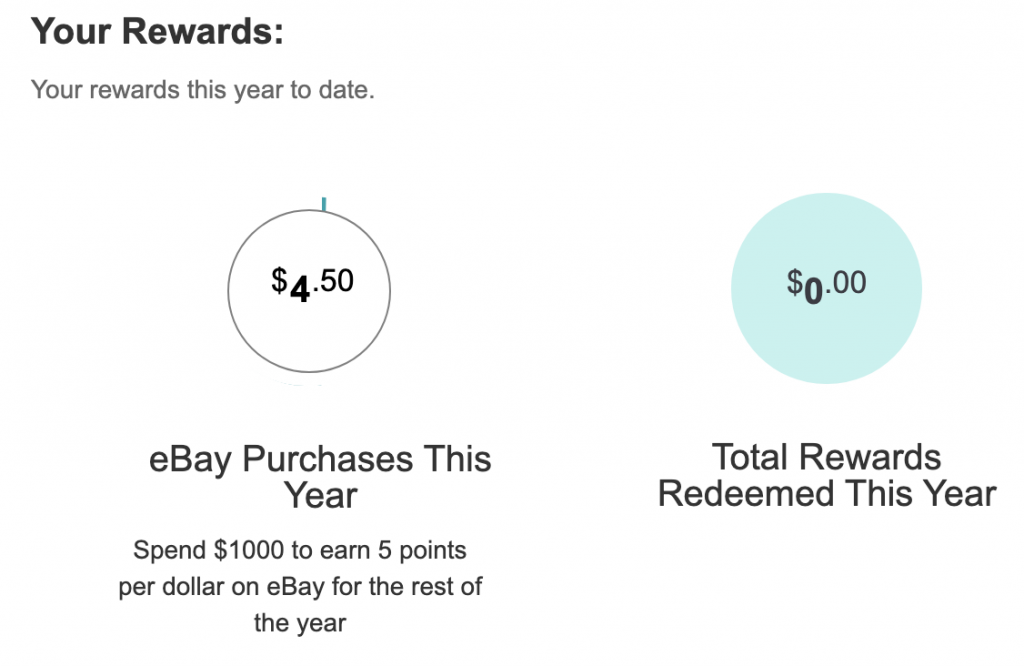

Keep in mind that after you spend $1,000 at eBay on the card, you will increase your earnings at eBay to 5 points per dollar spent. It is very easy to track your spending at eBay as a they added a tracker, where you can clearly see how much you have spent toward the $1,000 requirement. The bonus earning will kick in once you hit the requirement, and you will continue to earn 5x points per dollar spent at eBay until your card membership anniversary.

How To Redeem eBay Credit Card Rewards

Points earned on the eBay credit card can be redeemed for purchases on eBay. Once you accumulate 1,500 points you will be able to redeem $10 toward a purchase.

For customers that opened an account prior to July 16, 2019 they will automatically receive a statement credit of $10 for every 1,500 points earned. eBay stated that they will be transitioned grandfathered users to the pay with points option described above at some point in the future.

Points are worth $0.0067 per $1 spent, which equates to a 0.67% cash back on non-bonus category spend. That is very low. If you are going to use this card for everyday spending there are better options like the Chase Freedom Unlimited (1.5% cashback), or the Captial One Quicksilver card (1.5% cashback).

Spend on bonus categories such as gas, restaurants, and groceries is still sub-standard at 1.34% cash back. Even spending at eBay earns just 2.0% return, which is still weak. Your best option is hitting the $1,000 spending requirement at eBay to earn 3.3% cash back.

Other Considerations

- You must be an eBay member to apply for the card

- Reward points will expire in 24 months if you do not redeem them

- Points cannot be redeemed for select purchases including coins, bullion, paper money, classifieds, motors (except parts and accessories)

- Assesses a 3% foreign transaction fee

Can You Use eBay Credit Card to Pay eBay Seller Fees?

Unfortunately, eBay does not allow you to pay your eBay seller fees such as listing fees and final value fees with the eBay credit card. After getting this card I attempted to add it to my seller account to pay my outstanding eBay seller invoice and I kept receiving an error message. Although I could not find any policy or documentation stating that eBay prohibits using the eBay credit card to pay seller fees, I believe they secretly coded this on their site to prevent customers from meeting the $1,000 requirement by paying seller fees and then earning 3.3% cash back.

Bottom Line

The eBay credit card is a decent rewards card, especially if you can max out the $1,000 spending requirement on eBay in order to earn 3.3% cash back on all eBay purchases. For other spend such as gas, groceries, and restaurants the card is merely average to below average. You can find cards like the Amex Blue Cash, or Discover IT that will allow you to earn much higher cash back in bonus categories.

1 thought on “eBay Credit Card Review”