Over the holidays I flew to Hawaii and got stuck seated in a horrible economy seat near the back of the airplane. The American Airlines flight wasn’t as bad as I thought it would be, after all we were flying to Maui! But I did forget my kindle on the airplane and didn’t realize it until we arrived at our hotel. I assumed my Amazon Kindle was lost on the plane, and probably stolen by either the cleaning staff, or the next passenger seated there who found it, but I figured that I would at least call American Airlines to see if they happened to find it.

After wasting 30 min on the phone being told to call the airport, then being told by the airport to call the airline, I finally found a lost and found number at the airport and left a message. A nice staff member returned my call the next day and said they had not found a lost Amazon Kindle on the airplane flight I had been on. Well, I guess that confirms my intuition that my almost brand new Amazon Kindle Paperwhite was officially lost/stolen.

Filing A Lost or Stolen Claim With Your Credit Card

Most credit cards come with a “Lost or Stolen Protection” benefit in their credit card agreements. Most require that your item was lost or stolen within 90 days of your purchase and do not cover items left in a car, perishable items, and long list of other cases. Almost all American Express cards include this benefit, which I have used before, but I had purchased my Kindle with my Discover Card, so I wasn’t sure if Discover offered this a lost or stolen item protection. After doing a few quick searches, I found out that indeed they do! The Discover Card lost or stolen item insurance is actually provided by Federal Insurance Company.

I called Discover Card to file a claim and reported everything that happened. They told me that I needed to submit the following items in order for them to process my claim.

- Signed claim form

- Discover Card billing statement with the Amazon Kindle purchase shown

- Itemized receipt from Amazon showing the item purchased and paid for with Discover Card

- Written description of loss

Obviously this is a pain to gather and fill out all this paperwork, but I finally completed it after a few weeks. I had typed out my “written description of loss” in MS Word and then signed the letter, but the insurance company refused to accept that. I had to actually find a pen and rip out a piece of paper from my notebook and write out what happened like I was 4th grader. How annoying! Don’t they know I’m a blogger. I operate a paperless website where typing on a keyboard is my way of communicating?

Lost or Stolen Item Credit Card Claim Result

After all my work my claim was denied! I couldn’t believe it. Wasn’t my Kindle lost? Didn’t I try to get it back and airport lost and found was unable to find it?

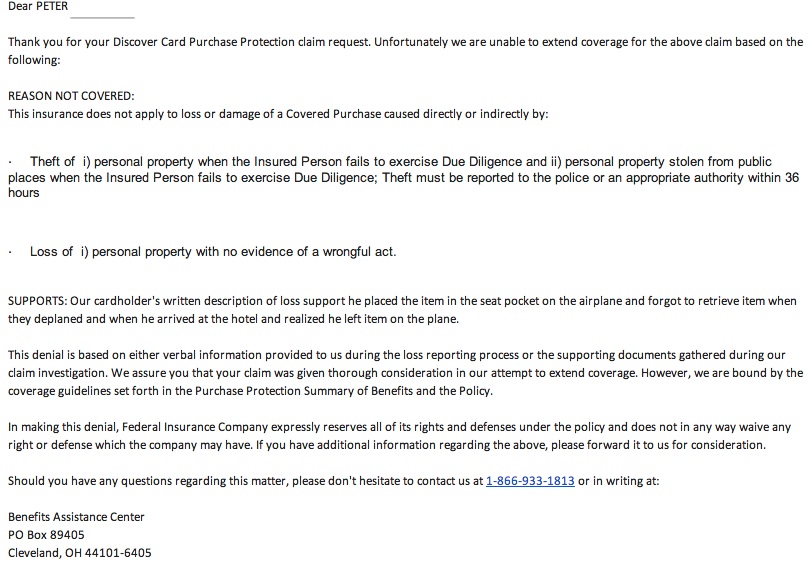

Here is a copy of the letter I received from the credit card insurance claims department.

Discover Card’s Lost or Stolen Item Protection is Worthless

Obviously, Discover Card’s interpretation of “due diligence” is ridiculously restrictive. When someone loses something, aren’t they not aware that they lost the item in the first place? Doesn’t not knowing when you lost something have to be the precursor to actually losing something? Heck, if I had known that I had left the item on the plane, I would have never lost it in the first place! Their interpretation of “due diligence” creates a catch 22, which I guess is what they want in the first place. That way they don’t have to pay out a claim whenever someone makes an honest mistake and loses something. What’s more American Airlines confirmed that they did not recover the item, so it had to have been stolen by someone right?

Bottom Line

The Discover Card lost or stolen item protection benefit seems totally worthless. If it doesn’t cover leaving an item on the airplane, then I don’t know what it actually covers. Next time you purchase something like an Amazon Kindle, make sure you do not use your Discover Card!

Thank you for this post. The exact same thing happened to me this week, where I left my Kindle in a plane. I was contemplating calling Discover card to ask about loss protection, but I guess that’s pointless based on your experience. I’m curious, though, did anyone ever follow up with you after you published your post?

Hi, no I did not get a follow up to my post. I think the claims are handled by a third party.