A few months ago I wrote a review about my first 60 days on Lending Club, which have gone very well. My goal was to earn at least 9%, which according to the company CEO Renaud Laplanche in this NBC interview, the average return for investors on the site is 6-9%. After my first 5 months I am now averaging 12.4% (shown in the screen capture of my account summary below), which is lower than the 13.3% I earned after my first 60 days on Lending Club, but is still pretty good.

Lending Club Review So Far

My first takeaway from the site is that it seems safe, which was my major concern going in. I was initially skeptical that Lending Club was full of fraudsters who would sign up for huge $30,000 loans and then leave town, but so far that has not been the case. Most borrowers seem to be honest people looking for a way to consolidate loans, refinance high interest credit card debt, pay for a home improvement project, or fund a major purchase (e.g. wedding expenses, auto loan, medical bills). After reviewing the notes in my account, it appears the most reliable borrowers are those who want to refinance or consolidate existing debt. This concept makes a lot of sense because in theory doing so does not increase the existing payment for the borrower. Refinancing should reduce the borrower’s payments, thereby lowering their risk of falling behind on payments. Of course, it would be remiss not to acknowledge that the person racked up huge amounts of credit card and other debt in the first place, so what’s to say that they don’t use the cash flow freed up by refinancing to buy more stuff?

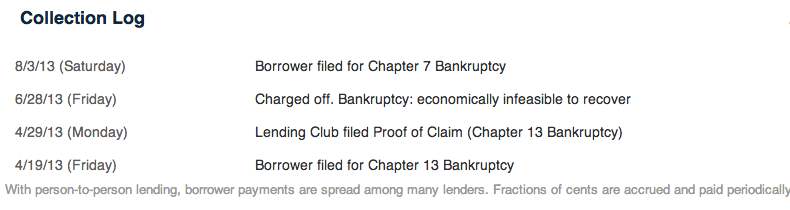

I think there are borrowers on Lending Club that do “get it” and are making an honest attempt at changing their lifestyle to be smarter about their finances, but the risk always exists that you buy a note that goes sour. I indeed have had one note where the borrower declared Chapter 13 bankruptcy and I lost everything that I invested in the note. The final outcome after my review of the Lending Club collection log for the note (displayed below), was the loan was economically infeasible to recover after the borrower first filed for Chapter 13 and then four months later filed for Chapter 7.

This note illustrates the risk that you take by investing on Lending Club. I indeed expect more notes to go sour and default, and I’m sure every financial institution that lends money to consumers at high interest rates accepts this risk. However, my goal is to minimize this risk so as to maximize my returns on the site and by doing so I have identified some strategies that you can take to minimize the likelihood that you invest in a bad note.

Lending Club Strategies

1. Do not invest in borrower who have a “public record on file” in their profile

A public record on file in Lending Club speak is typically a bankruptcy, legal judgment against, wage garnishment, or child support obligation against the person. I would guess that most likely it’s a prior bankruptcy, but it really could be anything. My opinion is that if a person has either declared bankruptcy in the past, or has a judgement against them, or is not paying their child support, then they probably do not take their finances seriously and are likely not to be a good lending risk. Of course, some reviews I have read online suggest that you can earn a much higher return, like 20% or more by investing in these notes, but that is a risk that does not appeal to me.

2. Do not invest in loans where the borrower has more than one credit inquiry in the last six months

One of the primary metrics that credit card companies use to evaluate an application is the number of hard credit pulls, or credit inquiries in the last 90 days. If you have more than 2-3 of these they will automatically deny your application. The rationale is simple. A person who has a lot of inquiries is considered desperate for credit, which is likely due to a financial hardship. While this may not always be the case, it does make sense and I personally have seen notes where the borrower has 2 or more credit inquiries on their Lending Club application go sour quickly. Of the 20 or so notes that have gone “In Grace Period” or “Late 15-30 days” on Lending Club, most have had two or more credit inquiries on their loan application.

3. Do not invest in loans where the payment exceeds 10-15% of the borrower’s income

If you think about it from a borrower’s perspective, the rule of payments not exceeding 10% of your income is obvious, but I don’t think a lot of people take this into consideration when they evaluate loans. Let’s calculate the finances of a typical borrower on Lending Club. For simplicity I will assume that borrower has $10,000 per month in gross income.

Income = $10,000

Minus Taxes – $2,500 (assuming effective tax rate of 25% for a married couple making $120,000).

Minus mortgage payment/rent – $3,000 (the federal limit is 36% of your gross income, and most people try to afford as much home as they can. I will assume 30% of their gross income).

Minus monthly expenses – $1,500 (I assume 15%, but it is likely to be higher).

Net Income Before Credit Card Debt or Lending Club Payments = $3,000 (30% of their income remainig).

Most of the applications I review on Lending Club have borrowers with 10-20% of their income going to credit card payments. If you assume that the number is 20%, then that leaves only 10% remaining for Lending Club loan payments! This does not even take into consideration car loan payments, student loans, or saving for retirement!

If a borrowers Lending Club loan payment is over 20% of their gross income, then this is a scary amount unless they use the loan proceeds to pay off all of their credit card debt and the only consumer loan payment they have is Lending Club.

Some people may argue that my assumptions are aggressive, but in my mind they are conservative. When lending money I would rather take reasonable risks based on logic, rather than assume the best case scenario for the borrowers financial situation.

Bottom Line

In my Lending Club review I discussed three strategies for mitigating your risk by selecting loans that are less likely to default. Of course this is not an exact science, but by taking steps to weed out bad borrowers, you can limit the downside in your portfolio. So far I am averaging over 12% in my portfolio, but that number could be higher if I targeted riskier loans. That strategy is simply not for me and I a more comfortable taking measured risks that limit the number of loan defaults. In the long run who knows if my strategy is better than another, but by following the three rules I outlined above, I think you will be on a good path to finding success investing on Lending Club.