One of the best ways to rack up tons of frequent flyer miles and hotel points is by signing up for credit cards and getting the huge sign up bonus. Banks will throw the kitchen sink at you to get you to sign up for their financial services products, and it would be stupid for us not to at least consider their overtures. However, to qualify for these large sign-up bonuses, credit card companies will impose minimum spend requirements of anywhere from $1,000 to $10,000. More often than not these minimum spend requirements will also come with a maximum time period as well (usually I have found that it is 90 day for smaller minimum spend thresholds, and 6 months for larger requirements).

This post will concentrate on how to easily meet minimum spend requirements without breaking the bank.

Kiva Loans

If you are in a bind to meet a required spend amount, a great way to not only rack up low cost spend, but to also help people in need is by making microfinance loans using Kiva Loans (Full disclosure: I do get a sign up bonus of one free $25 loan if you sign up through my link).

The great thing about Kiva Loans is that you can make loans to people (some are small business owners) in developing countries, which helps them tremendously. But what makes Kiva special is that they will allow you to fund loans using a credit card! When you check out, you simply select PayPal as your method of payment and use the credit card you have registered to your PayPal account to fund your loans. The transaction will go through as a regular purchase and you have now making progress toward meeting your credit card minimum spend requirement!

Are Loan on Kiva Safe?

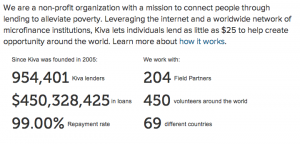

Many people are doubtful that they will actually get their loans repaid, especially considering these are microfinance loans made to people in developing countries. From my own personal experience 100% of my loans have been repaid and according to Kiva’s website the repayment rate is 99.00%. The screen shot below was taken from Kiva’s website and shows that the have made over $450 million in loans so far and 99% have been repaid.

How Long Until I Get Paid Back?

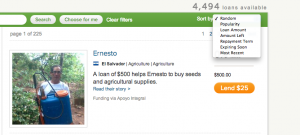

This is the key question of course! Considering that you are making a loan, if it takes years for the borrower to pay you back, then this does not help you much because your credit card bill will come due much sooner than you’ll ever even come close to getting repaid. Usually the repayment term is anywhere from 4 months to several years. In fact, this is one of the main criteria I use when selecting which loans to fund. When you are on the site browsing loans, you can use the filter on the top right corner to select repayment term as one of the sort criteria.

My Kiva Experience So Far

I have been very pleased with Kiva so far. As you can seen from a screen shot of my account, I have made 79 loans so far for $2,275. According to Kiva’s statistics this places me in the 99th percentile of their member base!

I initially started making loans on Kiva for the purpose of meeting my minimum spending requirement on one of my credit cards, but now that I haven’t applied for any cards in several months, I’m don’t have that need anymore. In fact, the last dozen or so loans I have made because I like the idea of helping the entrepreneurs on the site and I enjoy reading their stories. Occasionally I get an update email telling me that one of the loans I made helped someone raise their income and they had such a good experience that they are requesting another Kiva loan.

I initially started making loans on Kiva for the purpose of meeting my minimum spending requirement on one of my credit cards, but now that I haven’t applied for any cards in several months, I’m don’t have that need anymore. In fact, the last dozen or so loans I have made because I like the idea of helping the entrepreneurs on the site and I enjoy reading their stories. Occasionally I get an update email telling me that one of the loans I made helped someone raise their income and they had such a good experience that they are requesting another Kiva loan.

Bottom Line

I generally think Kiva is a safe place to make loans and it’s a great way to help meet minimum spend requirements on your credit card. Even if you are not interested in funding loans with a credit card, I think Kiva Loans is a great, low cost way to help people in developing countries increase their income and be better off.

Some truly quality weblog posts on this web internet site , saved to my bookmarks .