Now days it is nearly impossible to find a decent interest rate in a checking or savings account. My savings account with Citi is earning me a paltry 0.75%. Starving for yield and not wanting to take the risk of buying stocks or mutual funds in this market that has had quite a run recently, I discovered a peer-to-peer lending provider called Lending Club. Lending Club specializes in peer-to-peer lending, which means they provide unsecured personal loans to borrowers and source those funds from private investors like you or me, not big institutions. I really like the idea of it because normal people can earn a higher interest rate on their money, and borrowers can circumvent these gigantic banks to borrow money more cheaply.

How Lending Club Works

Each loan is funded through notes in increments of $25 or more. A typical investor will purchase these notes, and once the loan is fully funded, it is reviewed (and approved if everything checks out okay), and then funds are sent to the borrower. The borrower then must set up a monthly payment from their checking account and payments are withdrawn from their account once every 30 days. The principal and interest payments are then dispersed to investors like me. Lending Club makes money by charging investors a 1% fee for all loans made. From what I’ve read Lending Club is one of the largest peer-to-peer lending providers and also has an agreement with a large financial institution to buy their loan portfolio if they ever run into trouble. Although, I can’t see them doing so as they are not taking any risk, they are just collecting their 1% fee.

Lending Club Rate of Return

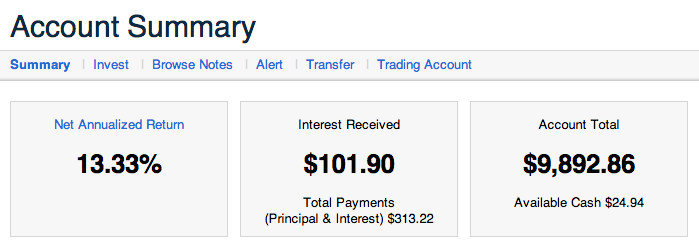

After my first 60 days on Lending Club, my return is 13.3% as you can see from a screen shot of my account summary below. I’ve been fortunate enough to not have any defaults yet, but I do expect them to come. Regardless, 13% is a great return in my opinion and I’m actually shooting for a 9-10% annual return, which factors in some defaults or charged off loans in the future.

Lending Club Basics

The nice thing about Lending Club is that they predetermine the interest rate for each loan using typical lending metrics. Some of the metrics they use include the borrower’s credit score, debt to income ratio, payment history, delinquencies, loan amount, outstanding revolving credit balances, etc. You can actually see all of this information in the details for each loan. I’m actually quite shocked by how much information is available, but I wholeheartedly welcome as much data as possible in order to make the best decision possible. You can find more about these metrics on their website. Lending Club then categorizes each loan by letter from A – G. According to Lending Club’s website the return for these loan types ranges from 6.78% for A1 loans to 29.99% for G5 loans. I find this rating system a good way to easily identify and select how much risk you want to take. Finally, the loan terms are either 3 years or 5 years, and Lending Club assigns a higher interest rate for longer term (5 year) loans.

My Lending Club Strategy

I did a considerable amount of research beforehand (and while) I was choosing what loans to fund/notes to purchase. I found some great blogs like this one about other people’s experience, which I used to craft my own strategy. In a nutshell, these are the factors I use to select notes to buy.

- No public records (AKA bankruptcy)

- No credit inquiries in the last 6 months (sometimes I will allow 1 depending on the quality of the borrower)

- Max debt to income ratio of 20%

- Lending club loan payment to income ratio of 10% (sometimes I will allow 15%, but never more)

- No more than one delinquency in the last year (I believe this means the borrower was more than 30 days late on a payment)

- No derogatory remarks in the last 3 years (I believe this means the person was more than 90 days late on a payment)

As you can see these are somewhat strict criteria, and they seem to have worked well for me so far, as I have only had 4 out of my 200+ notes go to “In Grace Period,” which means the borrower was 1-15 days late. The borrower did end up making the payment within the Grace Period.

Expected Defaults?

Since I’ve chosen to fund mostly B, C, and D loans, I do expect defaults. From what Lending Club has indicated the default rate for these types of loans should be around 4-5%. I’ve also purchased some E and F level loans to increase my yield a little, but those I do expect to have a higher default rate on. I just hope the borrower returns most of the principal to me before they hit a trouble spot.

Summary

Lending Club is a great way to add yield (and some risk) to your portfolio. For me it was a no-brainer compared to earning 0.75% in my savings account. With interest rates pathetically low, I don’t know of a better option besides maybe buying municipal bonds, than investing with Lending Club. That said, I may change my mind after a year when I begin to see defaults, but until then I quite happy with my return so far!

Can you tell us more about this? I’d want to find out some additional information.