One of the benefits of being a USAA member is having a Subscriber Savings Account (SSA). Members with a USAA insurance policy will automatically be enrolled in an SSA. Since USAA is a member-owned organization, part of the company’s capital is held by members in the SSA. Members usually receive an annual distribution from their SSA, which is approved by the Board of Directors and announced and paid in December. On October 21, 2003 USAA sent a message reminding members to update the account where they want their distribution deposited. The deadline to update your account setting is December 1, 2023.

The USAA Subscriber Savings Account distribution for 2023 was sent on December 10, 2023. Interestingly the distribution for me was much lower than last year. CEO Wayne Peacock stated that ongoing challenges in the macro environment are increasing costs of replacing homes and vehicles. This is forcing USAA to increase premiums to all members. I assume it is fair to suggest that elevated inflation is leading to higher replacement costs and extreme weather events due to global warming are resulting in more claims.

What is The USAA Subscriber Savings Account?

The USAA Subscriber Savings Account is an account held by USAA in the member’s name where capital is held for several reasons (see below). Since USAA is a reciprocal company inter-insurance exchange it cannot issue stock to raise capital, so it raises capital through other means such as through retained earnings. As a member-owned company a portion of USAA’s capital is held in each member’s Subscriber Savings Account. The funds in these accounts held USAA to do the following:

- Satisfy legal and regulatory requirements

- Support current and future operations

- Pay for significant unexpected loss due to member claims occurring from catastrophes

The board of directors may allocate funds to a member’s SSA based on USAA financial performance. The amount you receive depends on your existing account balance and the amount of auto and property insurance premiums you paid that year.

The account is not like a bank account as you cannot make deposits or withdrawals, or borrow against its balance. The account remains in effect for as long as you have at least one USAA auto or property policy. Hence, if you want to access the balance you would need to cancel all of your USAA insurance accounts.

A Subscriber Savings Account Statement including details on the amount of the 2022 allocation was sent on January 27, 2023.

What is a USAA Subscriber’s Account Distribution?

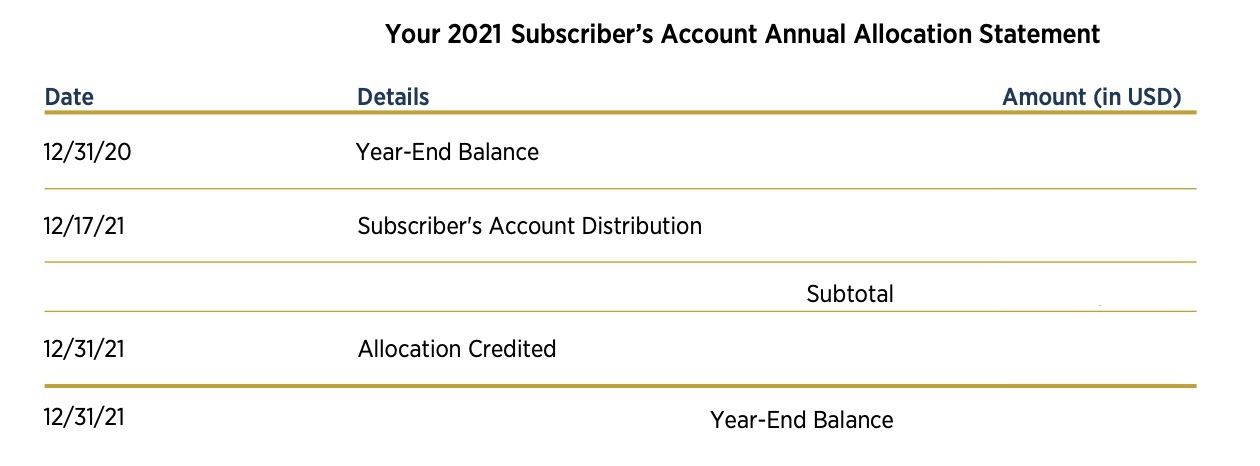

The USAA board of directors may authorize a Subscriber’s Account distribution annually. The distribution is a portion of the Subscriber’s Account balance paid out to the member. Below is my Subscriber’s Savings Account Distribution for 2019. As you can see it shows your Year-End Balance, the distribution made for that year, the allocation that was credited to your account and the final year-end balance in your USAA Subscriber’s account. You can expect to receive this statement in mid February each year. I received my Subscriber account statement on January 27, 2023.

Is The USAA Subscriber Savings Account Distribution Taxable?

The subscriber savings account distribution and senior bonus are considered a return of premium (insurance premium), and not income. Therefore, USAA subscriber savings account distributions are not taxable income for federal or state income tax purposes, so you will not receive a IRS form 1099.

How is The USAA Subscriber Savings Account Distribution Calculated?

A number of factors are considered by the USAA Board of Directors before the making a decision to distribute funds from the Subscriber’s Account. Some of these factors including the following:

- Regulatory requirements

- Financial requirements of the association

- USAA investment portfolio performance

- Operational performance

USAA does not disclose the formula used to determine the allocation amount. However, most familiar with the program understand the calculation to be a percent of the member’s outstanding Subscriber’s Savings Account balance. For instance, if the board of directors authorizes a 4% distribution for the current year, and your SSA balance is $1,000, you will receive a distribution of $40 that year. The distribution percentage varies year to year, historically averaging about 3-7% annually.

There may be other factors that may be considered in allocating the distribution to members including:

- Longevity of being a USAA member

- Amount of insurance premiums paid by the member that year

- Number of different accounts held with USAA

The “distribution” is different than an “allocation.” An allocation means that funds are added to your Subscriber Savings Account balance, whereas a distribution means that funds are paid out as cash to your account (you may choose the account where you receive the distribution).

How Do I Get My USAA Subscriber’s Account Distribution?

USAA has multiple ways for you to receive your SSA distribution:

- Apply your distribution to your USAA auto and property insurance bill

- Receive your distribution in your USAA Federal Savings Bank checking or savings account

- Receive your distribution in your USAA mutual fund

- Receive your distribution in a non-USAA checking or savings account

To change your distribution payment contact USAA customer service.

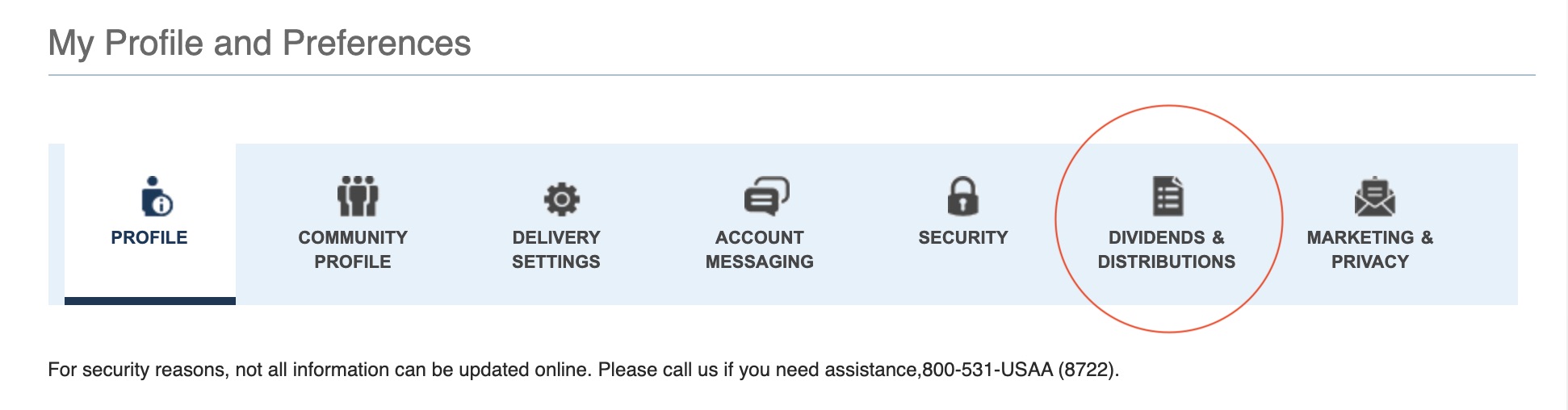

How Do I Change The Account Where I Receive My Distribution?

December 1st is the deadline to change the account where your distribution is sent. To set the account where you will receive your USAA SSA distribution follow these steps:

- Log into USAA.com

- Click on your name at the top right

- Select “My Profile & Preferences”

- Select “Dividends & Distributions”

- Click on “Get Started”

- Select your account in the Subscriber’s Account Distribution Preference drop down menu

Also, it is worth noting that USAA might apply your distribution to your Auto and Property insurance bill instead of depositing it into the account you selected. This may happen if you did not set a distribution receiving account, if your insurance balance was past due, if there was an issue processing your distribution preference.

How Do I Find My USAA Subscriber Savings Account Distribution?

To locate your USAA subscriber account distribution for 2019 you need to do the following:

- Log into your USAA Account

- Click on “My Tools” at the top of the page

- Select “View My Documents” which is circled below

- Locate the document titled “Subscribers Account Annual Statement (PDF)

Once you download the statement, your distribution amount for 2019 will be on the second line of the account statement. This is the amount that was sent to the account (e.g. checking, savings, etc.) that you selected for the distribution to be deposited in.

What is the USAA Senior Bonus?

The USAA senior bonus is a distribution to the Subscriber’s Savings Account for members with 40 years or more of membership. This is an option where members can receive up to 10% of their accumulated Subscriber Savings Account every year. One option that some take is to apply the USAA Senior Bonus to their homeowner’s insurance policy premium, or auto insurance policy premium. If you would like to receive your USAA Senior Bonus, you must call USAA at 800-531-3027 to request the bonus be paid out.

Can I Add a Beneficiary to My Subscriber Savings Account?

Yes, you may add a beneficiary to your USAA SSA account by calling 800-531-3027.

What Happens If I Cancel My USAA Account?

In accordance with USAA bylaws, they will send you the Subscriber’s Account balance six months after you cancel your auto and property insurance or terminate your account.

I am a USAA member, and was told the SSA account is not for every USAA member, Only Officers. I am former spouse of USAA member and I insure my home & auto through USAA. I was told I am not eligible for an SSA account.

I was not an officer in the military and I have an SSA account.

That is incorrect. You are eligible and will receive a distribution.

Last year the year end was issued on 10 Dec 19.

I was informed the same. I am former dependent of a USAA member and have had USAA insurance for almost 45 years.

Was a distribution approve for 2020, if so how do I find out the amount.

The USAA Subscriber Savings Account distribution for 2020 was sent to members accounts on 12/10/20.

I did not get a distribution this year and I normally do. I checked, nothing deposited on 12/10 or after..

Did you check all of your accounts, not just USAA accounts? My distribution was deposited into my USAA savings account, but you could have configured it to be sent to any account you have registered with USAA. After logging in click on your name at the top right, then select Profile and Preferences, click on Dividends & Distributions. There you will be able to view and select your Subscriber Account Distribution Preference using the drop down menu.

Is the SSA account just linked to P&C insurance. Meaning could I cancel my auto & homeowners insurance but keep my life insurance and banking with them and I would get back the SSA?

Does the senior subscriber savings account have a beneficiary indicator

You can add a beneficiary to your SSA. You need to request a form to fill out from USAA.

I had USAA under my ex husband prior to having it on my own. Is there any way those years can be included so that I qualify for the senior bonus? I was active duty enlisted and got my commission . I should have another 6 years added to my membership.

USAA terminated my auto insurance in 2021 and never sent me the balance of subscriber’s account. USAA claims my mailing address is not correct but I receive mail from every bank and everyone else except USAA.